Capital controls have essentially been the trait of all developing economies craving to defend their foreign exchange reserves against volatile capital flight. Policymakers worldwide are convinced that all nations should have their current account fully convertible but the same consensus have not been reached for capital account. Mavens have cited convertible current account as promotion of social welfare and liberalized capital account as an encouragement to plutocracy. The tightening of capital account has been seen especially after Asian Financial Crises in 1997. China has outperformed all its Asian counterparts in terms of internationalization of currency but has always ensured that there are adequate capital controls. Many economists had raised voices against capital controls and had blamed China for causing hindrance to international trade. They persuaded to emulate the free trade policies of U.S.A. However when U.S.A economic system got collapsed in 2007 they had to reconsider the international trade policies and accept the fact that some form of protectionism is necessary.

China has been in transitional period since 1978. During the commencement of reform period its per capita GDP was lower than India and Indonesia which today multiples GDP of both the nations. There has been a shift in pardigm as centrally planned economy is today propping up to become market economy. Internationalizing of currency began in late 2000s. For renminbi to be international currency it has to be circulated on fairly accessible basis and has to be net exporter of currency. China realizing it sooner started signing currency swap agreements with euro zone and other south East Asian countries. Shanghai free trade zone was launched in 2013 allowing RMB to flow freely between free trade account, non resident onshore account and offshore account. In 2014, Shanghai-Hong Kong exchange was launched in order to facilitate foreign investment into Chinese scrip. In 2015, another stock connect is planned linking Shenzhen and Hong Kong. Renminbi has also been included by IMF in its currency basket giving it a status of reserve currency. However transition from reserve currency to global reserve currency will be a distant dream for dragon economy.

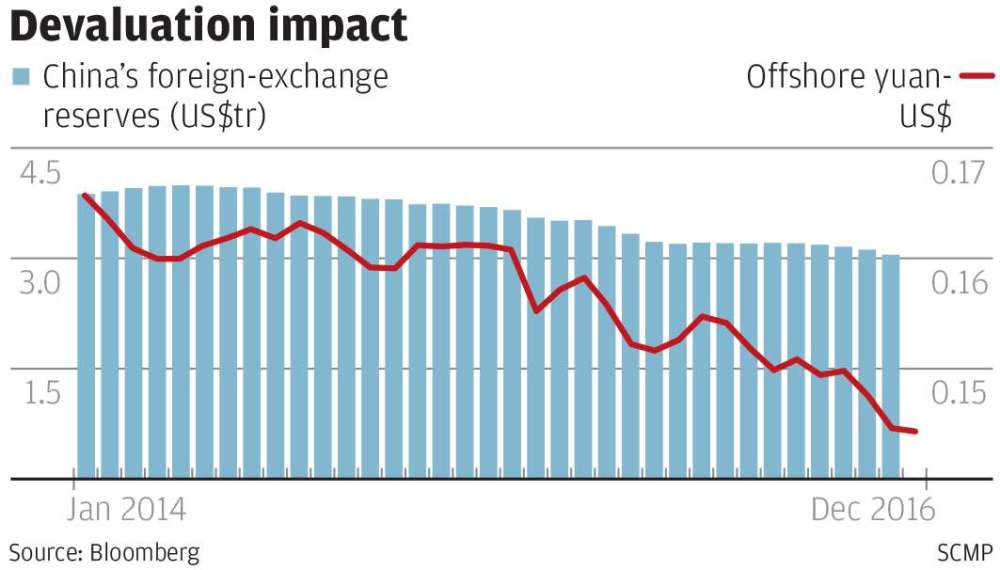

Despite of China having remained vigilant in advancement towards liberalization of capital account it hasn’t been successful enough to stop capital outflows from the country. People have found out innovative ways of moving the currency out of the nation. Even the real estate market which is prone to bubble have had a tepid growth thereby compelling the domestic investors to tap foreign markets. U.S.A has seen robust growth than Japan and Europe who are still struggling to find their feet despite of burning billion dollars. As a result of macroeconomic stability, dollar has been able to perform better than yuan.The Chinese currency has fallen 7 per cent against the US dollar this year, after a drop of 5 per cent last year. Appreciation of dollar will carry both positives and negatives for Chinese economy. Strengthening of dollar will give U.S Fed an indication of vigorous growth so it will rollback its large scale bond buying program (Q E). The yields which are at present near to zero will go up giving global investors an incentive to invest in the U.S.A while causing outflows from China. The economy has seen largest monthly decline of foreign exchange reserves since January and was similar to the average monthly reduction of US$70.1 billion from August to January. The balance of payment of China will further get exacerbated. However the depreciation of yuan against appreciation of dollar will give Chinese goods an edge over the U.S.A exports. It will aid China in bearing less brunt of its aggravating balance of payment.

The Chinese government have carried out a number of measures this year to control the outflow. Beijing is planning to focus on “extra-large” foreign acquisitions valued at $10 billion or more per deal, property investments by state-owned firms above $1 billion and investments of $1 billion or more by any Chinese company in an overseas entity unrelated to the investor’s core business. The People’s Bank of China also limited bank lending to the equivalent of 30 per cent of an applicant’s equity in an overseas firm in yuan. Hong Kong Monetary Authority increased the official base rate by 25 basis points to 1 per cent on 15 December, just hours after the US Federal Reserve increased the benchmark funds rate by 25 basis points (bps) to a range between 0.50 per cent and 0.75 per cent – the first rate rise in a year.

China has taken inference from the past and is trying hard to not let the history repeat itself. China is aiming at “partial” convertibility unlike U.S.A who had “fully” convertible capital account which completely got disintegrated causing the so called “Great Recession”. For any economy to have robust growth in long run it is necessary to integrate with global market along with necessary capital controls which can prevent meltdown.

BY: CHINTAN MATALIA

2, JAN 2017

Nicely articulated

LikeLike

Thoughtful post.

Thank ypu for following my blog.

LikeLike