In early 1990, the idea of having single currency was much talked about by policymakers in Europe irrespective of economic and cultural differences. Policymakers do realized that there were perils associated with having Optimum Currency Area (OCA) but untill 2008 merits appeared to outweigh demerits. In 1999 what appeared to be theory or abstract became a reality, this year marked the birth of Euro whose mettle was untested for 10 years but when tested it brought the economic carnage in Europe.

The theory of optimum currency area was pioneered by Robert Mundell. The merits of having single currency was that it will help to reduce transaction cost between European countries. With a single currency, there will be no longer a cost involved in changing currencies; this will benefit tourists and firms who trade within the Euro area. The studies have shown that in post euro era the tourism industry has seen significant rise of 6.5%. It has also eliminated the currency exchange risks. Euro appeared to be working quite well until the year 2009 wherein countries such as Spain,Portugal,Greece,Ireland,Cyprus were hit by major sovereign debt crisis. The country’s GDP to debt ratio got worsened. The countries were about to default on their debt as the interest rates surged unstoppingly and investors had lost confidence on sovereign debt as it received near to junk status from credit rating agencies. The countries were in much need of bailout which was provided by Troika(ECB,EUROPEAN COMMISSION,IMF). The bailout packages were accompanied by austerity measures which were essential to eliminate risk of moral hazards. Moral hazards were likely to appear in single currency sharing countries wherein countries are motivated to take more risks in a belief that costs of such risk shall be bored by others. There was almost 100% increase in GDP TO DEBT ratio in countries such as Greece and Ireland which normally is suggested should not increase more than 60%. Such moral hazards should have been broken at its very early stage of development which ECB failed to do.

It was expected that bailout packages will bring the countries out of debacle but the carnage continued as the austerity measures worsened the growth rate in these countries. The wave of deflation could have been fought if country had its own currency by way of devaluation which will increase the exports and decrease the imports bringing balance of payments in satisfactory position. Many countries resorted to internal devaluation in which the wages in labor market are reduced and several other internal adjustments were made to make exports more competitive. However it failed significantly as decrease in wage was disincentive to workers and productivity of goods manufactured declined and unemployment increased.

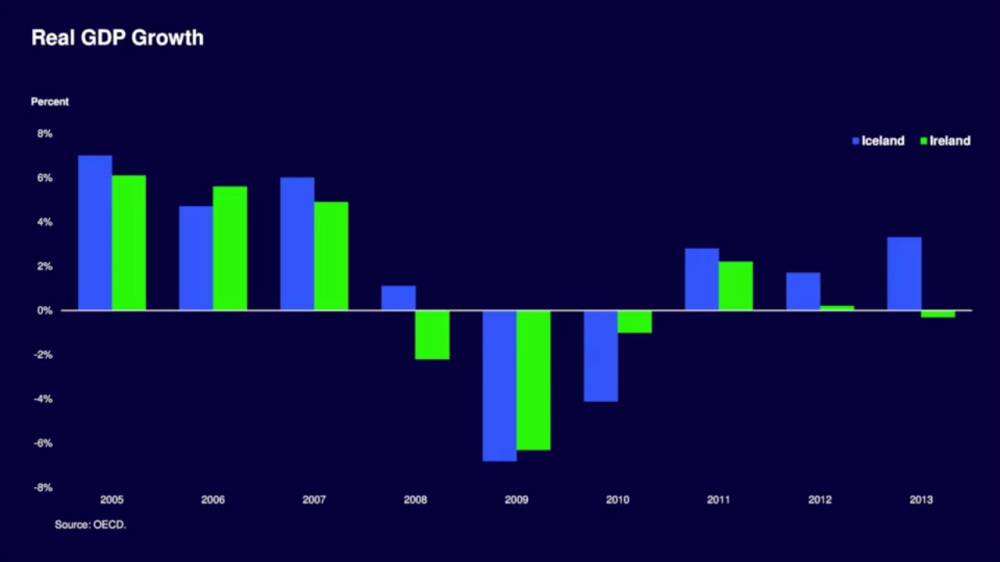

The comparisons of how Ireland and Iceland fought carnage are always drawn out and how Iceland had an edge over Ireland for having its own currency while Ireland was suffering from curse of Euro. Iceland’s financial system got disrupted during the crises and it defaulted on its external debt. However aftermath the crises it started devaluing its currency and thereby making exports more competitive which helped them to attain growth level of pre- crises level. However Ireland could not put on enough pressure on ECB to devalue Euro which is why even after getting bailout package it was not able to recover and had gone into another round of painful deflation. The charts given below gives testimony to this fact:

The diversity of economic conditions in each and every country has made monetary policy decisions difficult as there are countries like Germany and France which are having moderate growth rate while there are countries like Greece,Ireland,Spain wherein the growth rate is negative. The tightening of monetary policy by ECB in 2011 when Germany was facing inflation had spillover effects on South European countries which were still facing low growth rate. Thus Europe is not a optimum currency area.

In the aftermath of great recession USA recovered soon but Europe had delved into another recession with widespread unemployment of about 25% in Greece, 22% in Spain and 13% in Italy.

The major setback to the union was BREXIT in June 2016 whereby referendum took place in which 51.9% of votes were cast in favor of leaving . In the late of 2000, Union’s vulnerability to single currency market was exposed and even today no effective cure has been found for such economic impairment besides using of some unconventional monetary tools. ECB has been out of ammunition for a long time now failing to develop effective shock absorbers and fire fighting tools to fight crises. It is high time now for ECB to realize that cons of single currency are clearly outweighing the pros.

BY:CHINTAN MATALIA

27 OCT,2016

The article is well articulated and explains the concept thoroughly.

LikeLike

Thanx

LikeLike

An overall good job. A keen reader would be interested in knowing more thus providing in-text APA format citations will greatly increase the value of your writings.

LikeLiked by 1 person

Thanx for the response

LikeLike

ECB will n will have to provide stimulus until a sustained inflation rebound.

Let’s see in December 16.

Good gob dear, keep going…

I think u have better n best interest in Economy thn Accountancy.

All d best…!!

LikeLiked by 1 person

Thanx uncle for d response.

LikeLike

Good read. Keep it up.

LikeLike

The article gives a good insight about the concept. Overall a great effort.

LikeLike

A good article that elaborated almost everything and great efforts.

LikeLike

Thanx for the response

LikeLike

Good Article Overall!!!!!

There is one thing if you can make it more graphical next time then go for it as it will be more attractive to all & get more responses 🙂

LikeLike

Very thought provoking. Thank you for making me think more deeply about this important issue. Please keep writing!

LikeLike

Thanx….i hope i will be able to satisfy you in my upcoming articles

LikeLike